Why short-term declines are a part of building wealth over the long term

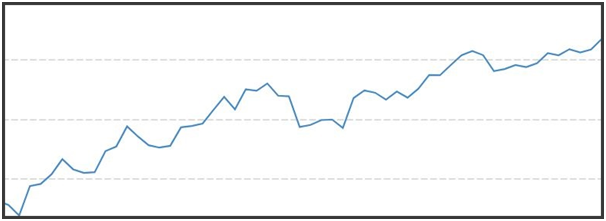

It is not possible to achieve great returns without going through some short-term declines. Look at this graph of the Nifty 50 index for a moment. Over what period do you think the market experienced these ups and downs? 1 month, 6 months, 3 years or maybe 10 years?

Just one hour, on 7thFeb 2018 from morning 12:00 AM to 1:00 PM. This graph shows that interim losses are possible even during the shortest of periods.

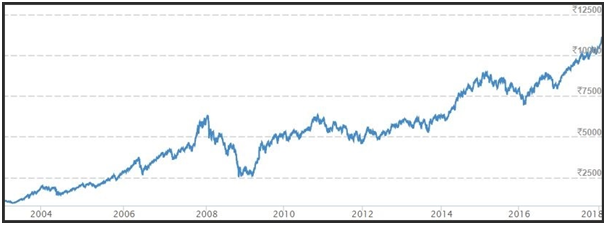

Let us look at a graph of the Nifty index to understand what to expect from the market if you want to create wealth over the long term. This graph shows how the markets moved from Feb 6, 2003 to Feb 6, 2018.

Nifty 50 – Feb 6th 2003 to Feb 6th 2018

Over this period, the index gave an amazing return of 887%, or 16.49% p.a. on an annual basis. But this period has also witnessed two to three instances every year of around 5% declines, two instances of close to 20% decline and one exceptional collapse of close to 50% decline during the global financial crisis. It’s evident that even the most impressive returns are not possible without going through some periods of significant declines.

What should you do as an investor?

1. Make sure that you are invested based on your risk profile. You shouldn’t decide to invest entirely in equities just because you want high returns. The amount of equity in your portfolio should depend on the potential downside that you can deal with without losing sleep.

2. Always expect volatility even in sound investments. Understand that such ups and downs are very normal in the market. Don’t react emotionally to such short-term fluctuations or take impulsive decisions as it could lead to mistakes.

3. Avoid anxiety and fear with the knowledge that you are invested appropriately. Do thorough research or leave it to the experts. If you know that the funds you are invested in have been picked after a lot of research, you’ll feel more confident about sticking it out and staying invested.